I-864 Affidavit of Support: What It Is and When It’s Required

When filing for a family-based green card, USCIS requires the petitioner to submit Form I-864, Affidavit of Support. This form ensures that the intending immigrant will not become a public charge by guaranteeing that the petitioner will financially support them, if necessary.

At GS LAW, APC, we guide clients through this critical step to ensure compliance with USCIS requirements. Below is a breakdown of everything you need to know about the I-864 Affidavit of Support.

When Does USCIS Require Form I-864?

USCIS requires submission of the I-864 in nearly all family-based immigration cases. Specifically, it must be submitted whenever an applicant is filing for adjustment of status or for an immigrant visa through a U.S. consulate. Without this form, USCIS will not approve the green card application.

Who Must Sign the I-864?

The I-130 petitioner—the U.S. citizen or lawful permanent resident who filed the immigrant petition—must always sign the affidavit of support, regardless of their income level. This is a mandatory requirement, and even if a joint sponsor is used, the petitioner still needs to complete and sign the form.

What Does the I-864 Measure?

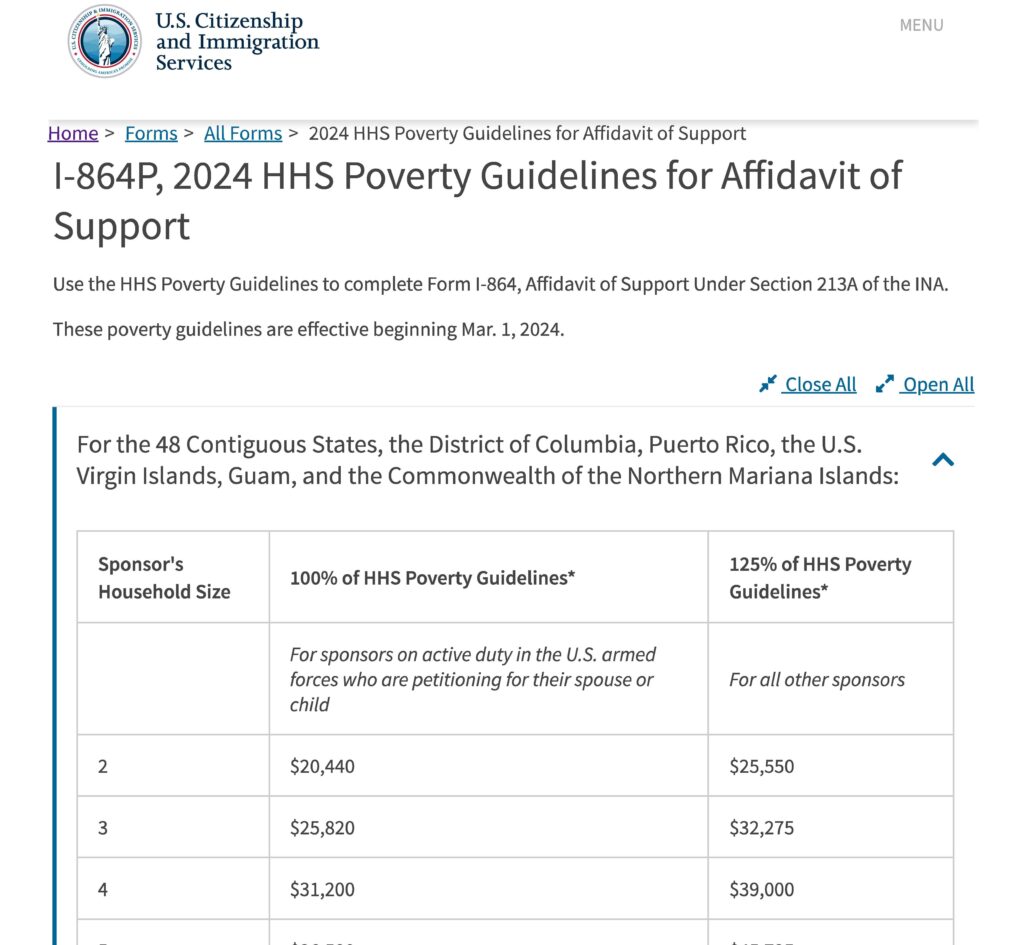

The I-864 Affidavit of Support measures whether the petitioner’s income meets or exceeds 125% of the Federal Poverty Guidelines for their household size. This ensures that the petitioner has the financial capacity to support the intending immigrant.

You can find the current poverty guidelines on the U.S. Citizenship and Immigration Services (USCIS) or Department of Health and Human Services (HHS) websites.

The 125% Rule and Using Adjusted Gross Income

The 125% rule refers to the petitioner needing to show income that is at least 125% of the Federal Poverty Guidelines. For most applicants, USCIS prefers the Adjusted Gross Income (AGI) listed on their most recent tax return to determine eligibility.

If the petitioner’s AGI meets the 125% rule, assets do not need to be disclosed, simplifying the process. Using adjusted gross income alone is typically the best approach, as it requires fewer supporting documents.

Click here to revie the table above.

Required Documents When Using Adjusted Gross Income Alone

If the petitioner qualifies based on adjusted gross income alone, they must submit:

- IRS Tax Transcripts (recommended) — These are official records of your tax returns and can be easily obtained from the IRS. Visit the IRS website at www.irs.gov/transcript to request tax transcripts.

- Alternatively, a combination of:

- 1040 tax returns (for the most recent year)

- Wage statements (W-2s or 1099s)

While submitting the latest tax return is often sufficient, USCIS may occasionally request tax returns from the last three years, so having those ready is a good idea. At GS LAW, APC, we help clients prepare and submit the correct documentation to avoid unnecessary delays.

What If Your Income Falls Below the 125% Rule?

If the petitioner’s income falls below the required 125% level, they can still meet the requirement by:

- Using Assets to Supplement Income

Assets can be used to make up the difference if income alone is insufficient. USCIS allows certain types of assets, such as cash in savings, property, and investments, to be included. Typically, the value of assets must be five times the difference between the petitioner’s income and the 125% threshold. - Using a Household Member’s Income

A household member can also help meet the income requirement by combining their income with the petitioner’s. The household member must complete Form I-864A, but we’ll discuss this in more detail in another post. - Using a Joint Sponsor

If neither income nor assets are sufficient, a joint sponsor can be used. A joint sponsor can be any U.S. citizen or lawful permanent resident, whether they are a friend, family member, or even a coworker. The joint sponsor must meet the same income requirements and provide their own Form I-864 with supporting documents.

Legal Implications of the I-864

It’s important to note that signing Form I-864 creates a legally binding contract between the petitioner (and any joint sponsor) and the U.S. government. This means that if the sponsored immigrant receives certain public benefits, the government can seek reimbursement from the sponsor. While we’ll discuss the specifics of these legal obligations in a future post, it’s something every petitioner and joint sponsor should be aware of before signing the form.

How GS LAW, APC Can Help

Filing Form I-864 can be complicated, especially if you’re unsure whether your income or assets meet the requirements. At GS LAW, APC, we provide personalized assistance to ensure your affidavit of support is properly prepared and submitted. Whether you need help gathering documents, understanding income requirements, or finding a joint sponsor, we’re here to help.

Schedule your free consultation today by visiting our website or contacting us directly.

Contact Us

📍 Office Address:

GS LAW, APC

15260 Ventura Blvd. Ste 1200

Sherman Oaks, CA 91403

🌐 Website: www.gslawoffice.com

📞 Toll Free: (800) 919-8959

📞 Local: (213) 725-2919

✉️ Email: info@gslawoffice.com

Let us guide you through the adjustment of status process with confidence!