Filing the I-864 Affidavit of Support is a critical part of the adjustment of status process for most family-based green card applications. USCIS requires this form to ensure that the intending immigrant will not become a public charge. This guide walks you through each step of completing the I-864 requirement correctly, helping you avoid unnecessary delays or rejections. If you need personalized assistance, contact GS LAW, APC for a free consultation at (800) 919-8959 or visit www.gslawoffice.com.

It should be noted that the following is not a step-by-step guide on completing Form I-864, but rather an analysis of the steps one should consider in meeting the requirements.

Step 1: Determine if the Sponsor is Eligible

The sponsor must be:

- A U.S. Citizen or Lawful Permanent Resident (LPR).

- At least 18 years old and domiciled in the United States.

In family-based cases, the sponsor is typically the petitioner who filed the I-130. If the petitioner’s income is insufficient, a joint sponsor may be added. However, joint sponsors must also be U.S. Citizens or LPRs.

Necessary Evidence:

- Proof of U.S. Citizenship (birth certificate, naturalization certificate, or U.S. passport).

- Proof of Lawful Permanent Resident status (green card or permanent resident card).

Step 2: Determine the Sponsor’s Household Size

USCIS uses household size to determine the income threshold for the sponsor. Household members include:

- The sponsor.

- The sponsor’s spouse.

- Any dependent children under 21.

- Anyone else listed as a dependent on the sponsor’s most recent tax return.

- The intending immigrant (beneficiary).

If the sponsor is using income from a household member to meet the income requirement, that household member must complete Form I-864A, Contract Between Sponsor and Household Member.

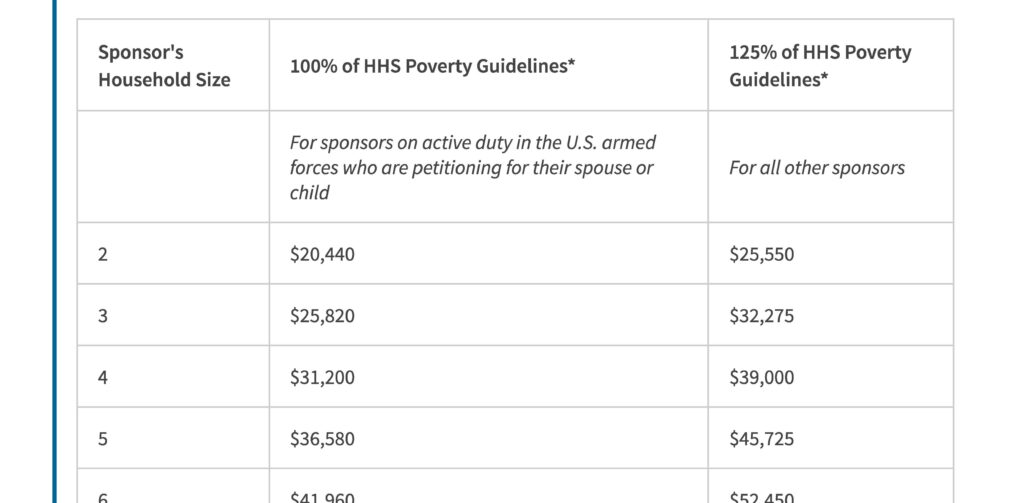

Step 3: Determine the 125% of Federal Poverty Guidelines

Sponsors must demonstrate that their income is at least 125% of the Federal Poverty Guidelines for their household size. The guidelines are updated annually and can be found on the USCIS Poverty Guidelines Chart.

For sponsors on active duty in the U.S. military petitioning for their spouse or child, the threshold is 100% of the Federal Poverty Guidelines.

Step 4: Determine if the Sponsor Meets the Income Requirement Based on Adjusted Gross Income (AGI)

USCIS evaluates the sponsor’s income stability based on the Adjusted Gross Income (AGI) from their federal tax returns. While only the most recent tax year is required, submitting the last three years of tax returns can help strengthen the case.

Preferred Documents:

- IRS Tax Transcripts (available at irs.gov)—these are the best evidence.

- Alternatively, a combination of the sponsor’s Form 1040 and W-2/1099 statements for the past year.

If the sponsor’s income meets or exceeds the 125% threshold based on AGI alone, assets do not need to be disclosed.

Important Note:

If the sponsor receives income from Social Security, retirement benefits, or other non-traditional sources, it’s advisable to consult an immigration attorney to ensure proper documentation and compliance with USCIS requirements.

Step 5: Using Assets to Supplement Income

If the sponsor’s income falls below the 125% threshold, assets may be used to make up the difference. The amount of assets required depends on the relationship between the sponsor and the beneficiary:

- If the sponsor is the spouse of the applicant, the required asset value must be at least three times the difference between the sponsor’s income and the poverty guideline threshold.

- For other relatives, the required asset value must be at least five times the difference.

Evidence Required:

- Bank account statements for at least 12 months showing sufficient balances.

- Ownership documents and current valuation of other assets, such as property or investments.

Step 6: Explore the Option of a Joint Sponsor

If the sponsor cannot meet the income requirement, a joint sponsor can be used. The joint sponsor must also be a U.S. Citizen or LPR and must file a separate Form I-864.

- The joint sponsor does not need to be related to the beneficiary; they can be a friend, co-worker, or family member.

- Joint sponsors must meet the same income or asset requirements as the primary sponsor.

Need Help? Contact GS LAW, APC

Completing the I-864 Affidavit of Support correctly is crucial to avoid delays in your adjustment of status application. If you need assistance or have questions, our experienced immigration attorneys at GS LAW, APC can guide you through the process.

📍 Office Address:

15260 Ventura Blvd. Ste 1200,

Sherman Oaks, CA 91403

📞 Toll Free: (800) 919-8959

📞 Local: (213) 725-2919

📧 Email: info@gslawoffice.com

🌐 Website: www.gslawoffice.com

We offer free consultations, so don’t hesitate to reach out for expert legal guidance.